Convert Charge-Offs into Instant Cash Flow

Landmark Strategy Group Has Monetized Over $1 Billion in Charged-Off Accounts for RTO/LTO Providers Nationwide.

HOW IT WORKS:

Submit Your Portfolio

Send us an Excel export of your charged-off account data directly from your system — including balance, charge-off date, and basic customer info.

Receive Your Cash Offer

We’ll review the information provided and send a clear, no-obligation cash offer — typically within 1–2 business days.

Get Funded

Once the offer is accepted, we’ll draft a PSA outlining the terms of the sale. Upon execution, our team will coordinate funding and ensure a smooth, secure transfer of payment.

Convert Charge-Offs into Instant Cash Flow

Landmark Strategy Group Has Monetized Over $1 Billion in Charged-Off Accounts for RTO/LTO Providers Nationwide.

HOW IT WORKS:

Submit Your Portfolio

Send us an Excel export of your charged-off account data directly from your system — including balance, charge-off date, and basic customer info.

Receive Your Cash Offer

We’ll review the information provided and send a clear, no-obligation cash offer — typically within 1–2 business days.

Get Funded

Once the offer is accepted, we’ll draft a PSA outlining the terms of the sale. Upon execution, our team will coordinate funding and ensure a smooth, secure transfer of payment.

About Us

Landmark Strategy Group, LLC

Landmark Strategy Group, LLC is a nationally licensed debt purchasing firm specializing in helping Rent-to-Own (RTO) and Lease-to-Own (LTO) providers recover value from non-performing accounts. With over $1 billion in charged-off portfolios successfully monetized, we deliver fast, compliant, and straightforward solutions that turn charged-off receivables into immediate working capital.

About Us

Landmark Strategy Group, LLC

Landmark Strategy Group, LLC is a nationally licensed debt purchasing firm specializing in helping Rent-to-Own (RTO) and Lease-to-Own (LTO) providers recover value from non-performing accounts. With over $1 billion in charged-off portfolios successfully monetized, we deliver fast, compliant, and straightforward solutions that turn charged-off receivables into immediate working capital.

Benefits of a Debt Sale Transaction

With Landmark Strategy Group, LLC

Immediate Cash Flow

Turn stagnant, non-performing accounts into working capital without waiting on collections or legal recoveries.

Zero Collection Headaches

No more chasing down skips, staffing collectors, or dealing with broken promises

Found Money Scenario

We buy accounts up to 5 years past due — often already written off — turning lost revenue into found money.

Risk Offloading

Selling charged-off accounts transfers the risk, legal exposure, and compliance responsibility away from your business.

Save Time & Resources

Free up internal staff to focus on paying customers — not unresponsive accounts.

Transparent & Compliant

SOC 2 Type II compliant and nationally licensed — we handle every transaction with integrity.

Benefits of a Debt Sale Transaction

With Landmark Strategy Group, LLC

Immediate Cash Flow

Turn stagnant, non-performing accounts into working capital without waiting on collections or legal recoveries.

Zero Collection Headaches

No more chasing down skips, staffing collectors, or dealing with broken promises

Found Money Scenario

We buy accounts up to 5 years past due — often already written off — turning lost revenue into found money.

Risk Offloading

Selling charged-off accounts transfers the risk, legal exposure, and compliance responsibility away from your business.

Save Time & Resources

Free up internal staff to focus on paying customers — not unresponsive accounts.

Transparent & Compliant

SOC 2 Type II compliant and nationally licensed — we handle every transaction with integrity.

"We Partnered with Landmark for our debt sales solution this year. They are focused on maximizing the return of our charged-off accounts in a compliant & efficient manner"

Chief Finance Officer

-Top 5 Retail Franchise Store

"We Partnered with Landmark for our debt sales solution this year. They are focused on maximizing the return of our charged-off accounts in a compliant & efficient manner"

Chief Finance Officer

-Top 5 Retail Franchise Store

How Our Process Works

Portfolio

Valuation

We begin with an initial review of your charged-off accounts. You provide an Excel export, and we deliver a no-obligation cash offer based on current market value.

Warehouse

Purchase

Once accepted, we complete a lump-sum purchase of your current charged-off portfolio — giving you immediate working capital for accounts you’ve likely written off.

Forward Flow Establishment

After the initial purchase, we can establish a forward flow — allowing you to offload new charge-offs on a recurring basis (monthly, quarterly, etc.) for consistent cash flow.

How Our Process Works

Portfolio

Valuation

We begin with an initial review of your charged-off accounts. You provide an Excel export, and we deliver a no-obligation cash offer based on current market value.

Warehouse

Purchase

Once accepted, we complete a lump-sum purchase of your current charged-off portfolio — giving you immediate working capital for accounts you’ve likely written off.

Forward Flow Establishment

After the initial purchase, we can establish a forward flow — allowing you to offload new charge-offs on a recurring basis (monthly, quarterly, etc.) for consistent cash flow.

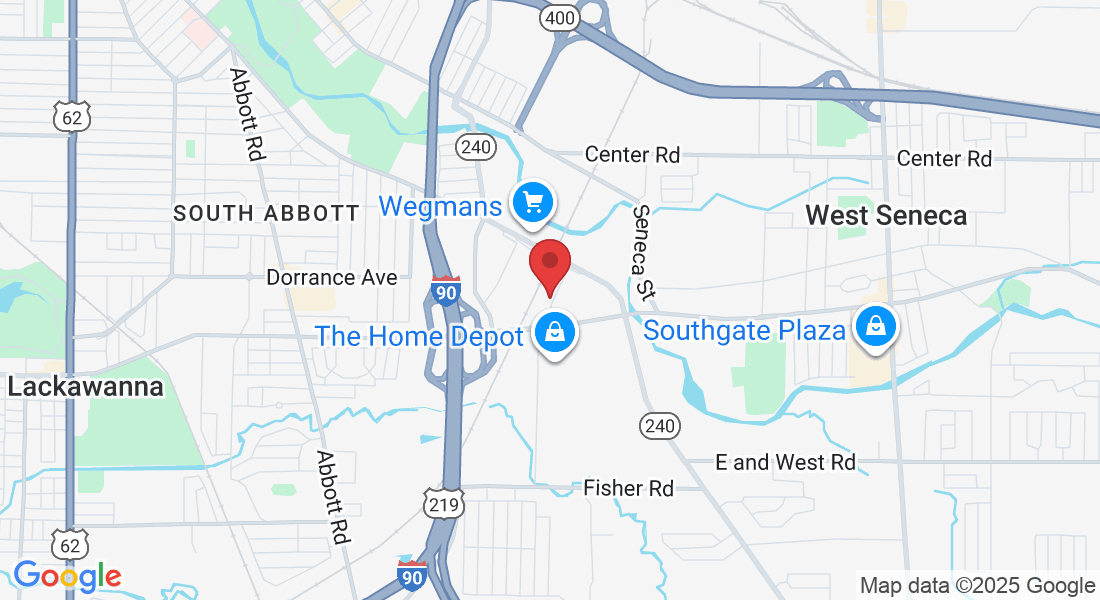

Get In Touch

Hours of Operation:

Mon – Fri 8:00am – 5:00pm

Phone Number:

(716) 558-5811

Email:

[email protected]

Website:

www.thelandmarkcorp.com

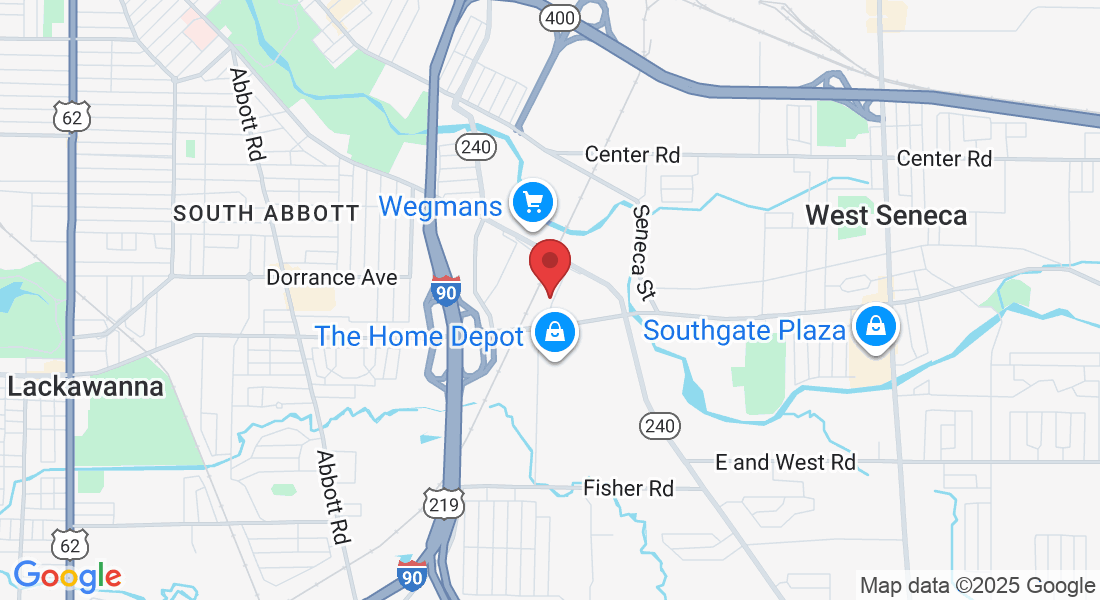

Get In Touch

Hours of Operation:

Mon – Fri 8:00am – 5:00pm

Phone Number:

(716) 558-5811

Email:

[email protected]

Website:

www.thelandmarkcorp.com